Noram Completes Phase Iv Drill Program On Zeus Property Clayton Valley And Examines Outlook On Lithium

Vancouver, British Columbia – January 9, 2020 – Noram Ventures Inc. (“Noram”) (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) is pleased to announce that the Company anticipates the release of the Phase IV drill results in short order. Six drill holes were completed to depths beyond the previously drilled 100ft with an HQ-size core, which renders larger samples and improves core recovery; the deepest of which reached 392ft. In total, 1154 additional ft of drilling were completed. The Company has explored approximately 30% of the 12 square kilometre property to date, and only 20% of the property with the deeper drilling.

Why Lithium?

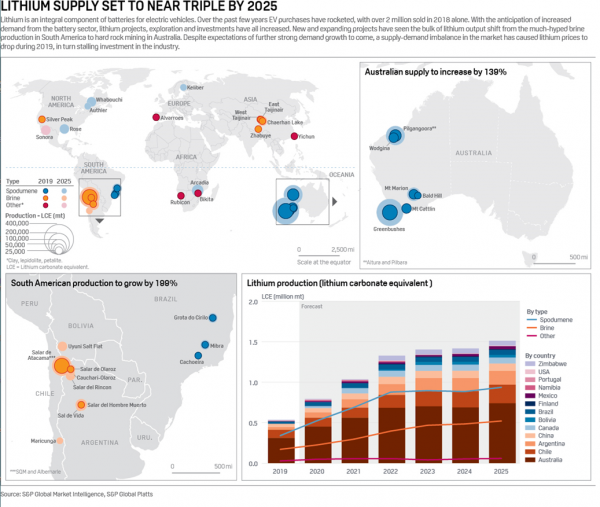

The consumpution of lithium for batteries has increased significantly in recent years due to the use of rechargeable lithium batteries in the growing market for portable electronic devices, electric tools, electric vehicles (over 2 million vehicles sold in 2018 alone according to S&P Global Platts Analytics) and grid storage applications. These utilizations are a major demand driver – fueling the need for batteries and consequently the demand for lithium. Battery giants around the world are presently scaling up lithium-ion production with mega-factories and are actively acquiring the raw material through off-take and joint-venture agreements.

According to a press release by Tesla Inc. dated January 3, 2020, the company delivered approximately 367,500 vehicles in 2019, which was 50% more than in 2018. Tesla is now shipping its vehicles to more locations around the world than ever before, including in the U.K. and China. The company announced its intention to focus on expanding production in both the US – there are major state tax incentives for sourcing the lithium supply locally - as well as the newly launched facility in Shanghai. Despite breaking ground at Gigafactory Shanghai less than 12 months ago, Tesla has already produced just under 1,000 customer salable cars and has begun deliveries. Tesla has also demonstrated production run-rate capability of greater than 3,000 units per week, excluding local battery pack production which began in late December.

Additional large-scale lithium-ion battery factories are under construction around the world and are based on the potential of lithium batteries becoming an all purpose energy storage unit that are highly scalable.

China set major targets for the 13th Five-Year Plan (2016-20) period: to become the world’s largest producer of EVs, and to develop lithium battery materials as a top priority. Though China has its own lithium reserves, domestic recovery is limited, and China has chosen to secure lithium mining rights abroad.

China saw its lithium supply grow to 8,000 metric tons last year from just 6,800 metric tons in 2018. While lithium production is comparatively low, China is the largest consumer of lithium due to its electronics manufacturing and electric vehicle industries. It also produces nearly two-thirds of the world’s lithium-ion batteries and controls most of the world’s lithium processing facilities, according to data from Benchmark Mineral Intelligence.

The Future of Lithium

2020 is anticipated to be a key year for the future long-term lithium supply: if enough new projects don’t source the required financing in the coming months, the current oversupply is likely to suddenly shift into shortage in a few years as electric vehicles spread out globally. Production of the battery metal is set to almost triple by 2025 to more than 1.5 million metric tons, and there are concerns that a fall in upstream investment could flip the market into undersupply further out.

The private sector is responding proactively to the EV-related policy signals and technology developments. Recently, German auto manufacturers such as Volkswagen announced ambitious plans to electrify the car market. Volkswagon has partnered with a Chinese lithium producer as part of its goal to launch the largest “E-offensive” in the automotive industry, and has increased its projections from 15 to 22 million electric vehicles built on their e-platforms worldwide by 2028.

Chinese manufacturers such as BYD and Yutong have been active in Europe and Latin America to deploy electric buses. European manufacturers such as Scania, Solaris, VDL, Volvo and others, and North American companies (Proterra, New Flyer) have been following suit. In 2018, several truck manufacturers announced plans to increase electrification of their product lines.

Noram management believes that the timing is excellent for developing the Zeus lithium project. The goal is to complete the evaluation of the significant claystone resource in 2020 and then focus on lithium extraction and building a mine over the next several years to benefit from the strong demand in 2025 and the following decades, as the global auto producers go electric.

About Noram Ventures Inc.

Noram Ventures Inc. (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) is a Canadian based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company’s primary business focus since formation has been the exploration of mineral projects. Noram’s long term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramventures.com

ON BEHALF OF THE BOARD OF DIRECTORS

/s/ “Anita Algie”

Director and Chief Financial Officer

Office: (604) 553-2279

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.